Loan Manager Annual Plans

See Monthly Plans instead (Note: Monthly Plans are 23% more)

30-day Trial* / Free

$0

2 Users

1 Account Owner + 1 Additional

3 Contacts

3 Schedules

Both Active and Archived

Dashboard Payment List

Only During 30-day Trial

Personal

$9.75

/month (billed annually)

3 Users

1 Account Owner + 2 Additional

3 Contacts

5 Active Schedules

10 Archived Schedules

Dashboard Payment List

Business/Pro

$19.40

/month (billed annually)

10 Users

1 Account Owner + 9 Additional

Unlimited Contacts

Unlimited Active Schedules

Unlimited Archived Schedules

Dashboard Payment List

All plans include: Document Templates, Automated Document Workflow, and Learning Center Resources

* No credit card required for the Free or Trial plans. The Trial plan includes everything in the Free plan + the Dashboard Payment List (a Personal/Pro plan feature). After 30-days the Trial plan converts to a Free plan and the Payment List is disabled.

For plan changes on an existing Personal or Professional account please contact support.

Refund Policy: Pre-paid subscriptions may be refunded at any time upon written customer request to support@moneytools.net. Annual pre-paid subscriptions will be adjusted to reflect monthly billing.

Example: User pre-pays 12 months for Personal plan and requests a refund in month 6...

Original payment 9.75 x 12 = 117

6 months used @ monthly rate 12 x 6 = - 72

Refund Amount = 45

What People Are Saying

Intuitive

Peace of Mind

Streamlined

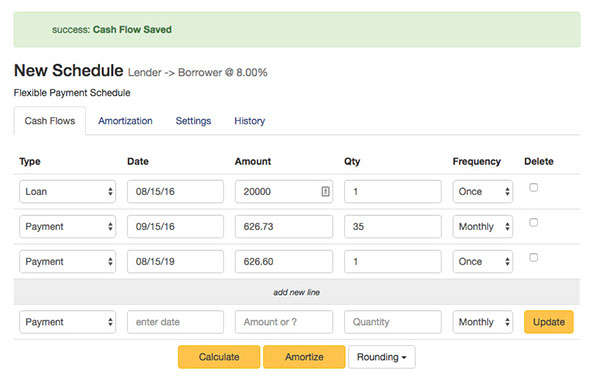

Flexible Payment Schedules

From simple to complex…whether it’s a traditional loan structure, interest only, or a special deal with multiple cash flows at different dates (i.e. a line of credit)…

You’re covered with the Loan Manager.

- Estimated 5 minutes to register and create your first schedule

- Unlimited Cash Flow entries

- Schedule history to quickly recover from mistakes

Payment Tracking

Never worry about missing another payment and falling behind. Manage all your schedules and payments from an easy interface designed with thoughtful input from experienced clients.

- Key payment information on one screen

- Schedule details and payment notes one-click away

![]()

Document Templates

Some loans require legal documents…even loans to your own business if you want to maintain a good liability shield.

Download these templates and use them over and over again to maintain clear records.

- 9 pre-configured document templates + extras

- Add custom fields and edit wording to fit your exact needs

Automated Workflow for Document Templates

Use the automated workflow built into each document template to save time and streamline your editing process.

No need to read through line-by-line every time you need a document...just follow the prompts.

- Compatible with Microsoft Word (Mac or Windows)

- Supports custom fields

Note: Requires Microsoft Word (Mac or Windows)

Additional Users

Stop worrying about the bookkeeping. Add your personal assistant, bookkeeper and/or accountant so you can focus on your strategy and enjoy the benefits of a money manager.

- You stay in control with 3 user-access levels (View Only, Add/Edit, Admin)

Learning Center

Specific Audio and Video training on:

- How to use the Loan Manager

- What you need to know to build personal and business loans correctly

- Best practices for loan documentation

Includes diagrams for understanding of how schedules and documents fit together in a business loan.

Data Security

We use standard TLS/SSL encryption (AES128 or 256) to establish a secure connection from your computer to MoneyTools.net and the server hosting the Loan Manager app.

We also use a variety of programming and server security measures to protect against XSS, CSRF, SQL injection, DDoS and other malicious attacks.

The server hosting the Loan Manager app is automatically backed up every week and backups are kept for 4 weeks.

Payment information is handled through Stripe Checkout or PayPal so your credit/debit card number is never passed through, or stored on our servers.